China PSC Scorecard L36M (Sep. 2020 – Aug. 2023)

This RISK4SEA Report about PSC inspections in China for the last 6 months (Sep. 2020 – Aug. 2023) includes China vs Tokyo MoU Detention Rate (DER) and the most common detainable deficiencies per fleet segment.

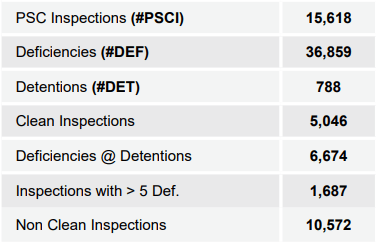

Key PSC Figures in China

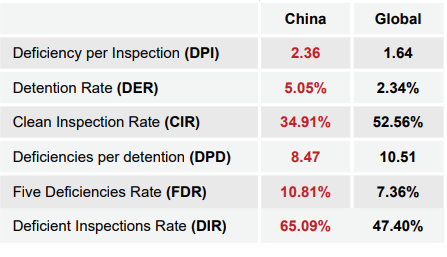

Key Performance Indicators (KPI)

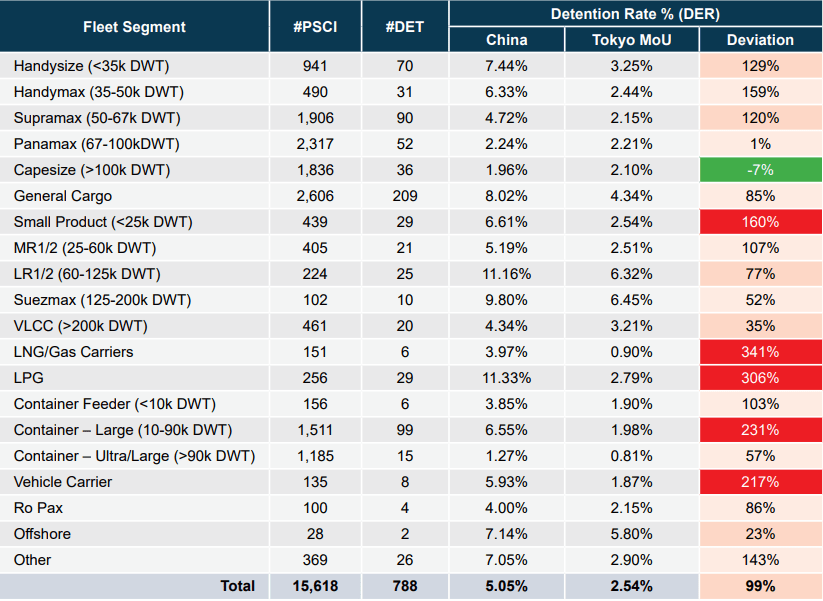

China DER % vs Tokyo MoU DER %

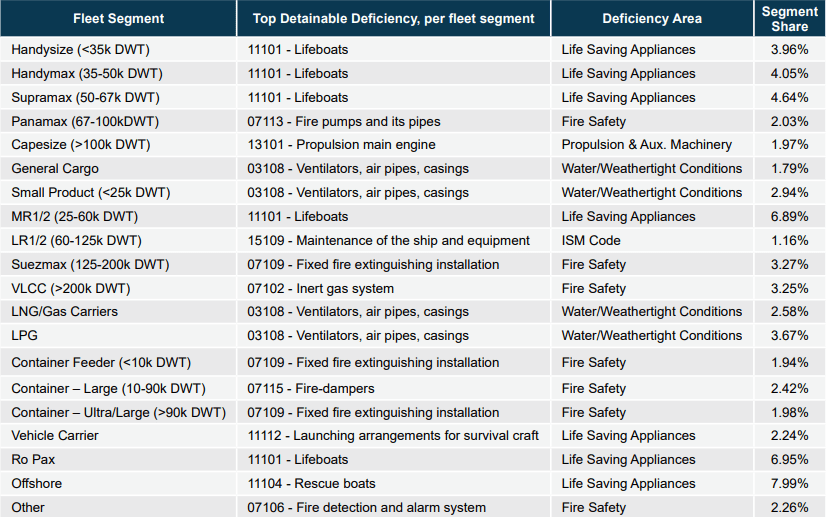

Most Common Detainable Deficiency, per fleet segment

Highlights

- China PSC has been fully recovered from COVID period. The remote inspections have been minimized and inspections numbers recovered to pre-COVID period

- Except Capesize ships all other fleet segments mark Detention Rates higher than Tokyo MoU Average

- Most detainable deficiencies vary in different segments and cover mostly the areas of Life Saving Appliances, Fire Safety, Water/Weathertight Conditions varying from segment to segment

About RISK4SEA | www.risk4sea.com | Client List https://bit.ly/3L4ulcI

RISK4SEA is a SaaS PSC Intelligence platform, illuminating PSC performance to Prepare/Assess PSC inspections, Benchmark against competition and Automate PSC functions and alerts to eliminate detentions and minimize OPEX.