PSC Highlights for Ports – CY2021

This RISK4SEA Report about PSC Highlights for Ports 2021 includes ports with high number of inspections and detentions per fleet segment.

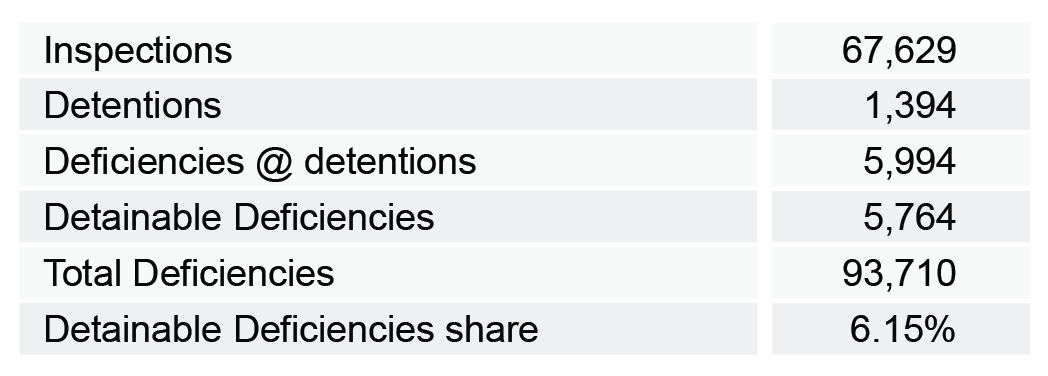

Key Figures (CY 2021, Ocean Going Ships)

PSC KPIs

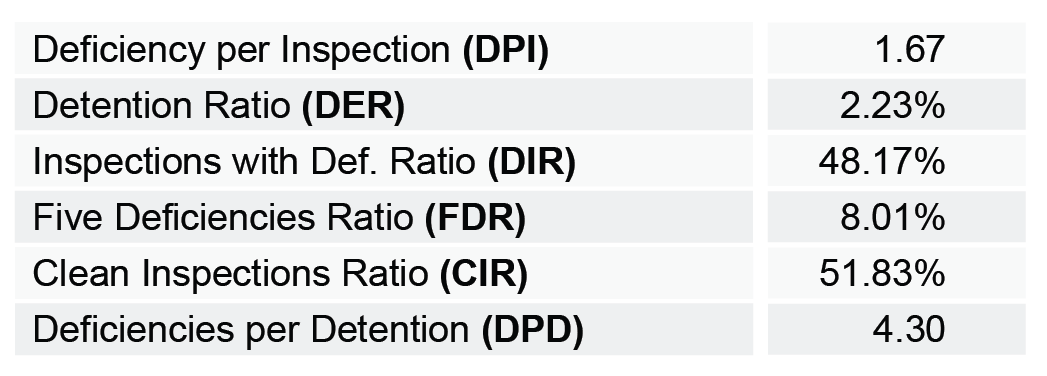

Ports with Highest Number of Inspections and detentions per Fleet Segment (CY 2021)

Bulk Carriers

![]()

Most Challenging port: NOVOROSSIYSK (Russia)

40 detentions for Bulk Carriers in 411 inspections

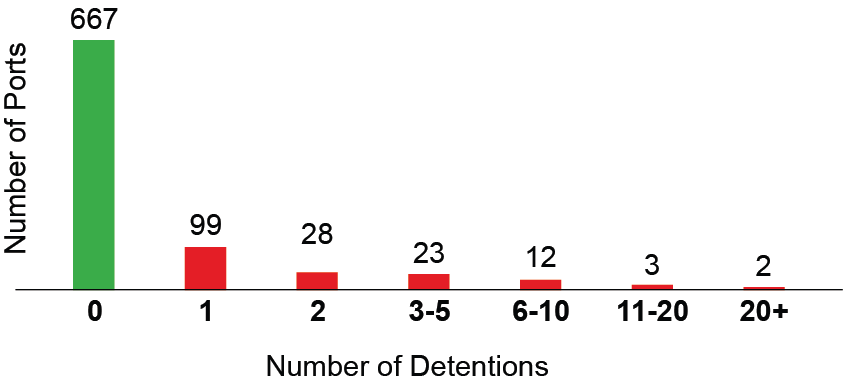

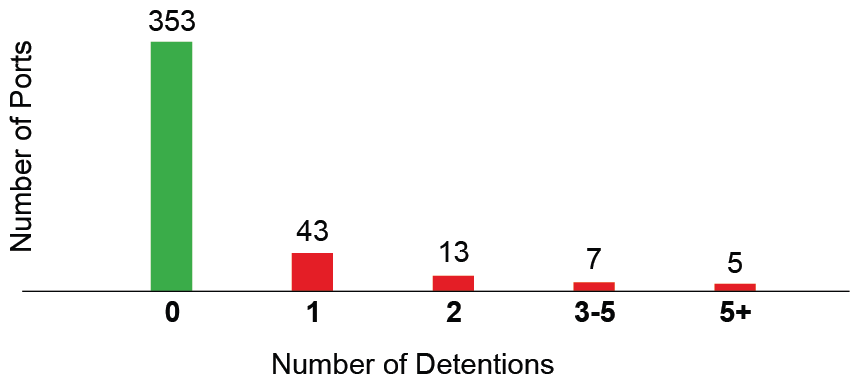

Distribution of Detentions per Port – Bulk Carriers

General Cargo

![]()

Most Challenging port: NOVOROSSIYSK (Russia)

28 detentions for General cargo in 234 inspections

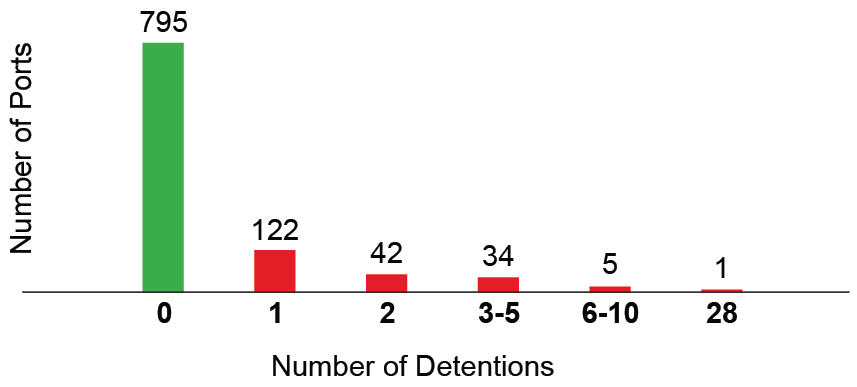

Distribution of Detentions per Port – General Cargo Ships

Oil Tankers

![]()

Most Challenging port: NAKHODKA (Russia)

5 detentions for Oil Tankers in 65 inspections

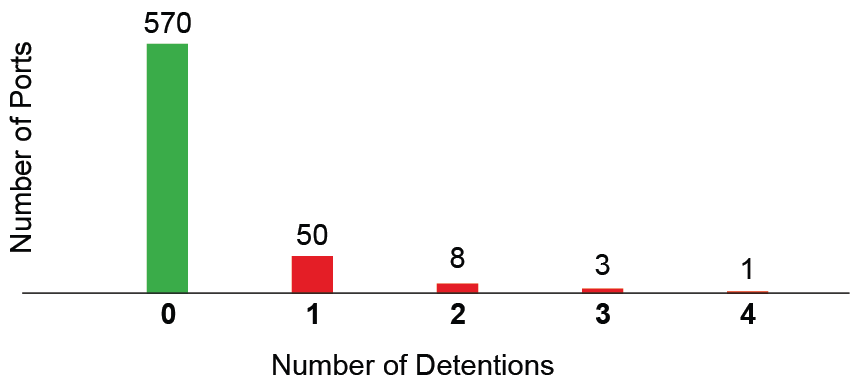

Distribution of Detentions per Port – Oil Tankers

LPG Carriers

![]()

Many Ports with 1 detention | Most Challenging port:

BANDAR ABBAS (Iran) with 2 Inspections – DER – 50%

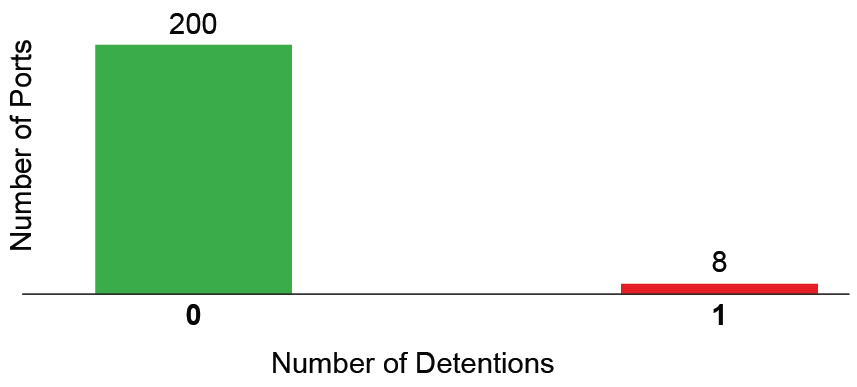

Distribution of Detentions per Port – LPG Carriers

Containers

![]()

Most Challenging port: FREMANTLE (Australia)

5 detentions for Containers in 32 inspections

Distribution of Detentions per Port – Container Ships

About RISK4SEA | www.risk4sea.com | Client List https://bit.ly/3L4ulcI

RISK4SEA is a SaaS PSC Intelligence platform, illuminating PSC performance to Prepare/Assess PSC inspections, Benchmark against competition and Automate PSC functions and alerts to eliminate detentions and minimize OPEX.