PSC Highlights for Ports 2020

This RISK4SEA Report about PSC Highlights for Ports 2020 includes ports with high number of inspections and most common detainable deficiencies in global ports per ship type.

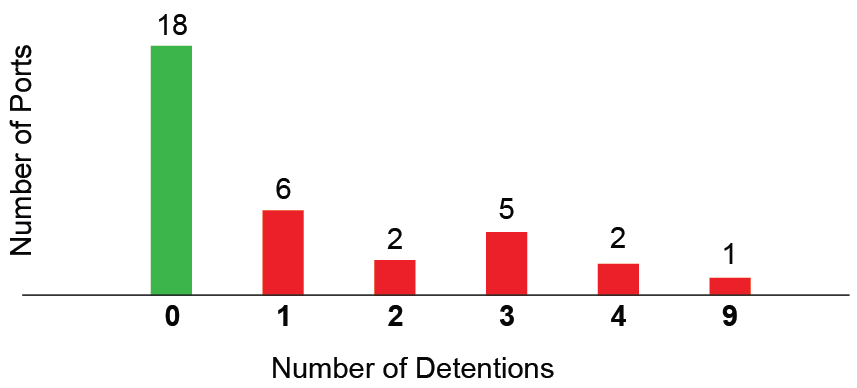

Key figures

PSC KPIs

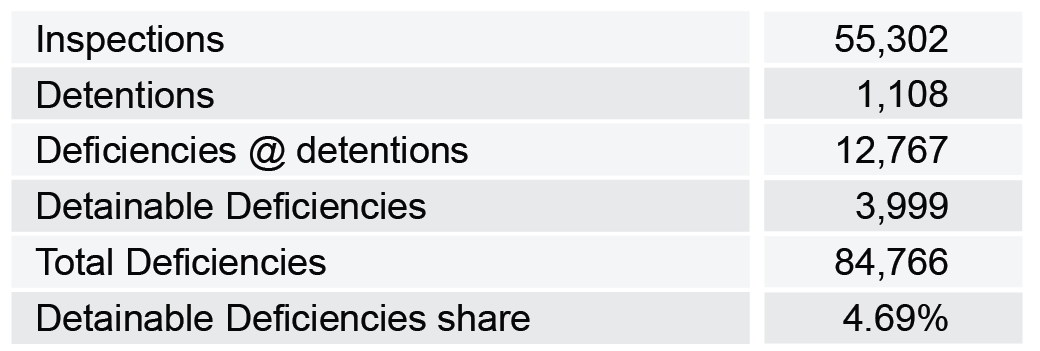

Top Ports with High Number of Inspections

Most Common Detainable Deficiencies in Global Ports per Ship Type

ISM (codes 15150 & 15199) are Top Ranked as Detainable Deficiencies in almost all ports, however in all PSC reports these codes are used supplementary to other deficiencies in order to highlight ISM compliance failure.

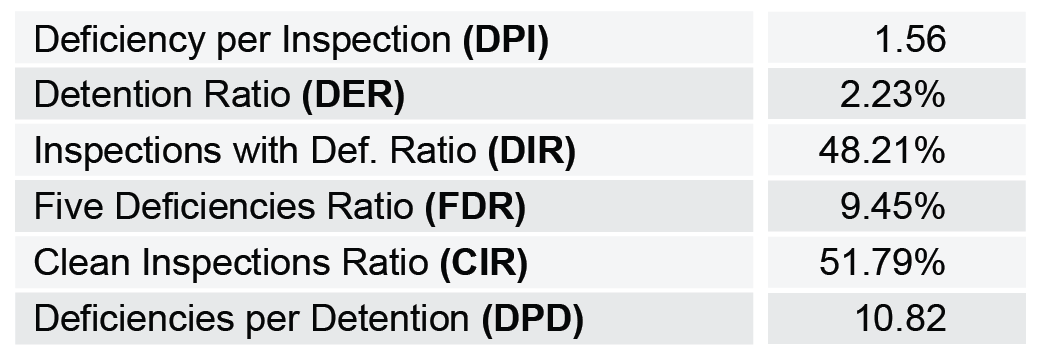

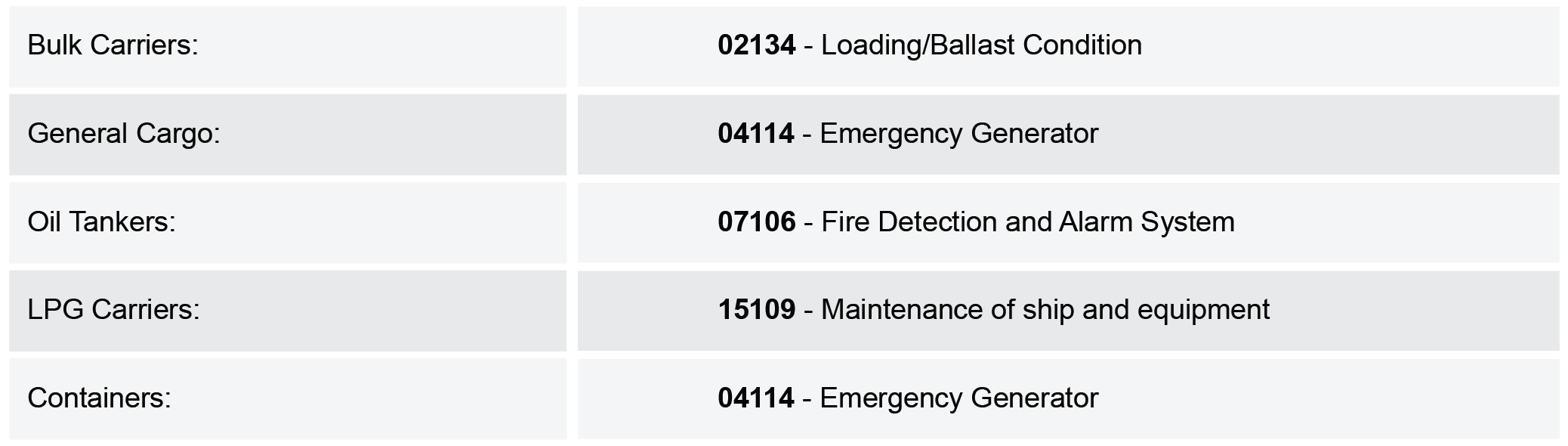

Bulk Carriers

![]()

NOVOROSSIYSK (Russia) /

40 detentions for Bulk Carriers in 494 inspections

Bulk Carriers Distribution of Detentions

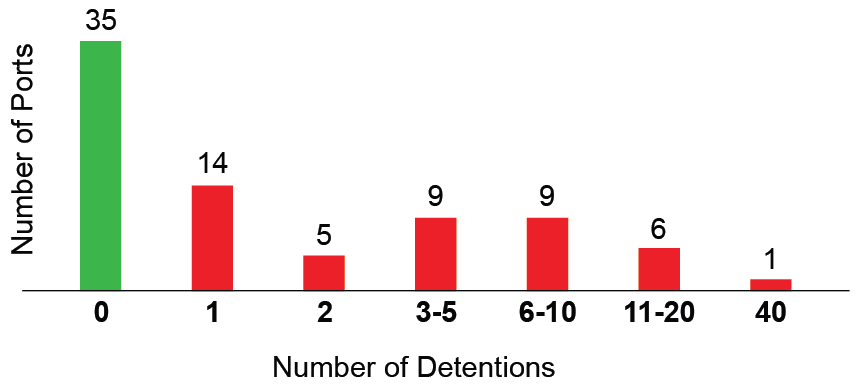

General Cargo

![]()

NOVOROSSIYSK (Russia) /

36 detentions for General cargo in 312 inspections

General Cargo Distribution of Detentions

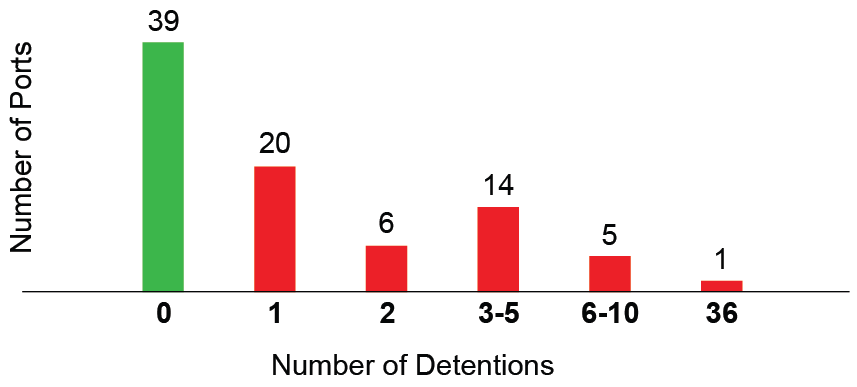

Oil Tankers

![]()

NOVOROSSIYSK (Russia) /

10 detentions for Oil Tankers in 469 inspections

Oil Tankers Distribution of Detentions

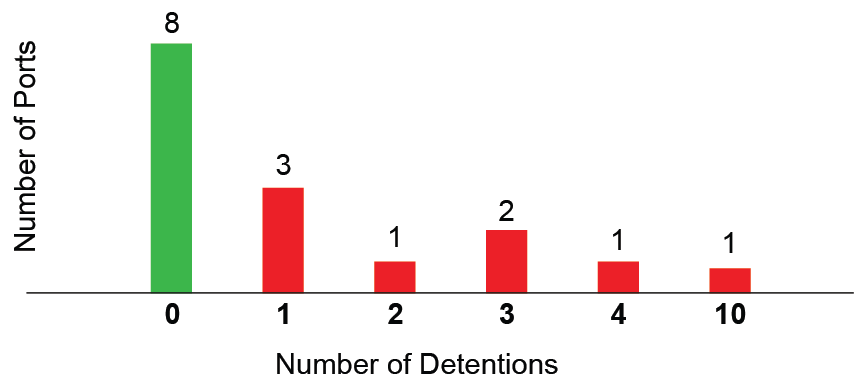

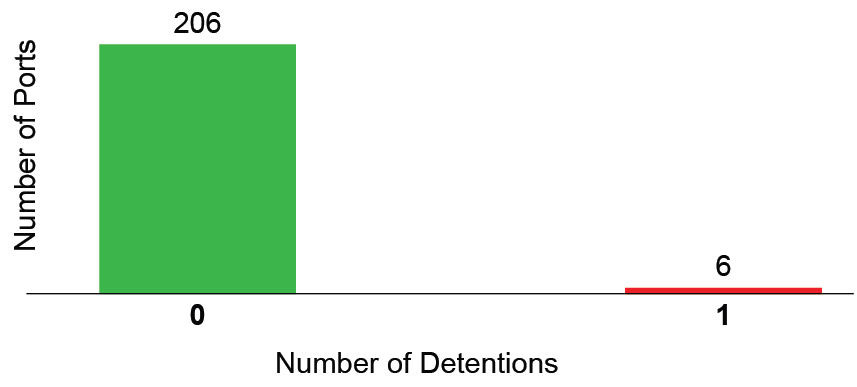

LPG Carriers

![]()

From Ports with 1 detention most challenging

ODESSA (Ukraine) with 6 Inspections – DER – 16.5%

LPG Carriers Distribution of Detentions

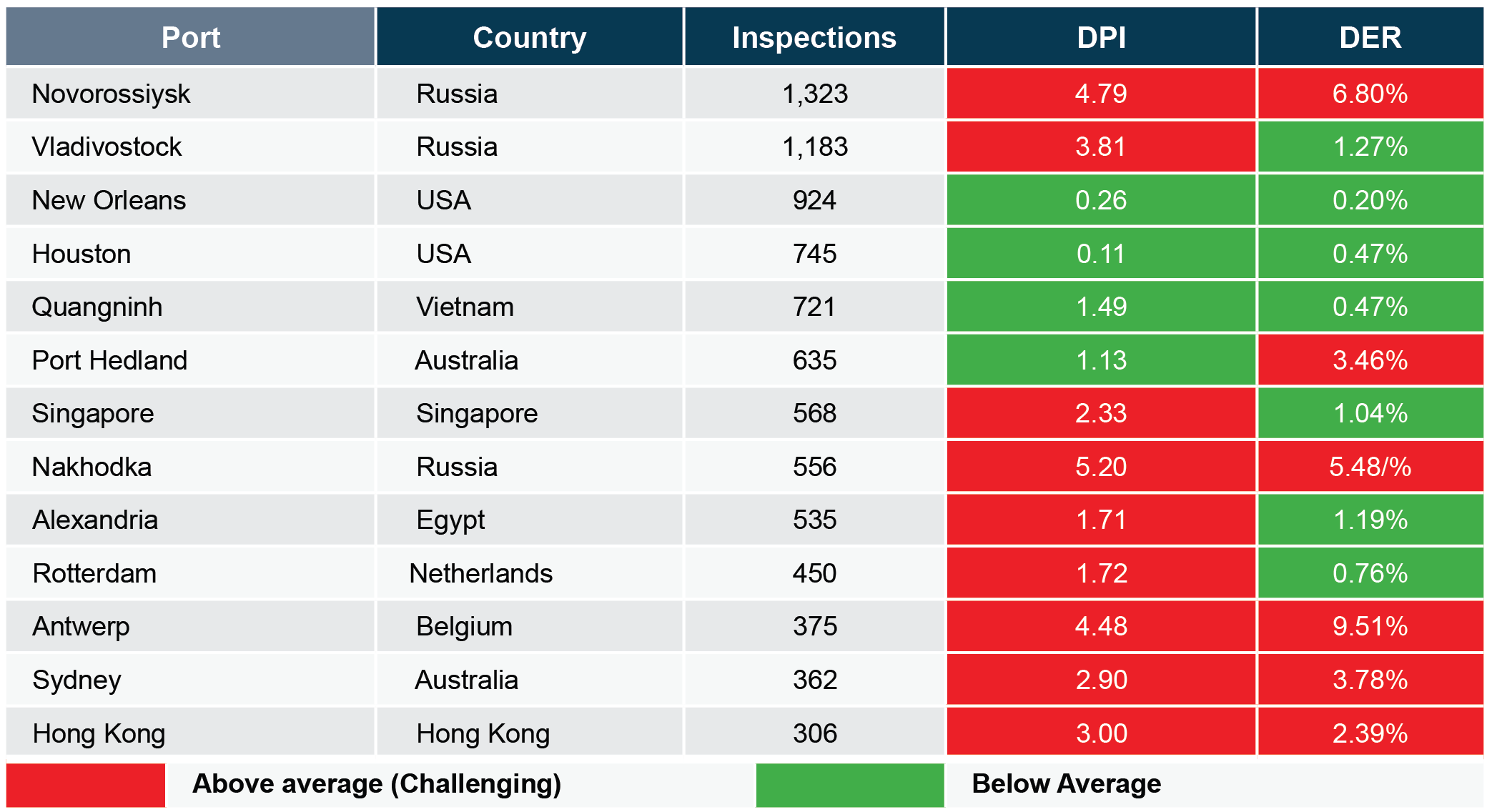

Containers

![]()

SYDNEY, NSW (Australia) /

9 detentions for Containers in 224 inspections

Containers Distribution of Detentions